Venturing into the dynamic world of forex trading requires a robust understanding of market forces and analytical techniques. That guide delves into the intricacies of forex analysis, equipping you with the knowledge to make informed trading decisions. We'll explore fundamental and technical analysis, revealing key indicators, chart patterns, and risk management strategies that can empower your belajar forex dasar trading journey.

- Grasping fundamental analysis involves evaluating macroeconomic factors such as interest rates, inflation, and economic growth to gauge currency strength and forecast future price movements.

- Graphical analysis focuses on studying historical price data and trading volume to identify patterns and trends that may signal potential buy or sell opportunities.

- Identifying key indicators like moving averages, oscillators, and support/resistance levels can offer valuable insights into market sentiment and momentum.

By honing your analytical skills and applying proven strategies, you can navigate the complexities of forex trading with confidence. This comprehensive guide will serve as your roadmap to success in the exciting world of currency markets.

Unlocking Fundamental Analysis for Forex Success

Forex trading is a complex market where success hinges on understanding both technical and fundamental factors. While technical analysis delves into price patterns and chart formations, fundamental analysis provides a deeper insight into the economic forces driving currency fluctuations. By mastering fundamental analysis tools and indicators, traders can obtain a competitive edge in predicting market trends. This involves analyzing key economic data releases like interest rate decisions, GDP growth, and inflation reports, as well as monitoring geopolitical events that can impact currency values. A solid understanding of fundamental analysis allows traders to make informed trading decisions based on the underlying stability of a country's economy.

- A thorough knowledge of monetary indicators is crucial for effective fundamental analysis.

- Recognize key events and data releases that can significantly impact currency pairs.

- Develop a systematic approach to analyzing economic news and reports.

Deciphering Technical Indicators in Forex Trading

Successfully navigating the volatile realm of forex trading necessitates a keen understanding of technical indicators. These powerful tools provide invaluable insights into market movements, enabling traders to make more informed decisions. By decoding key indicators such as moving averages, RSI, and MACD, traders can pinpoint potential trading entry/exit points. However, mastering the art of deciphering technical indicators demands a combination of theoretical knowledge and practical experience. A thorough grasp of these indicators coupled with a sound trading strategy can significantly enhance your chances of success in the forex market.

Mastering the Forex Market Through Technical Analysis

Technical analysis functions as a powerful tool for investors navigating the volatile realm of the forex market. By scrutinizing price action and past data, traders can uncover potential signals that forecast future price shifts.

Employing technical strategies such as moving averages, support and resistance levels, and chart structures, traders can acquire valuable knowledge into the market's direction. These analytical methods can improve a trader's ability to place informed decisions and reduce losses.

While technical analysis can be a effective tool, it's important to remember that the forex market is inherently unpredictable. Traders should always practice caution and manage their risk effectively.

Delving into the Art and Science of Forex Trading Analysis

Navigating the dynamic world of foreign exchange speculation requires a potent blend of artistic intuition and robust research. Traders must possess the capacity to analyze intricate market movements, identifying profitable situations. A deep comprehension of fundamental and technical elements is crucial, as shifts in global economics can swiftly influence currency values.

- Effective forex trading analysis involves a holistic approach, integrating both qualitative and quantitative methods.

- Traders often depend a variety of charts to predict future currency performance.

- Additionally, keeping abreast of current events can provide invaluable knowledge into market outlook.

The art and science of forex trading analysis is a dynamic landscape, requiring traders to be adaptable and passionate to continuous growth.

Transition From Novice to Pro: Mastering Forex Trading Analysis

The realm of forex trading requires a deep understanding of analysis. From identifying market trends to analyzing technical indicators, proficient traders possess a potent arsenal of tools and strategies. Beginners often struggle in navigating this intricate landscape. Nevertheless, with perseverance and the right guidance, anyone can progress from a novice to a skilled forex analyst.

- Begin your journey by grasping fundamental analysis, which involves scrutinizing economic indicators and news events that influence currency fluctuations.

- Explore technical analysis, where you'll employ chart patterns, indicators, and other techniques to forecast price directions.

- Refine your risk management skills by adopting stop-loss orders, position sizing strategies, and portfolio management techniques to minimize potential losses.

Consistent learning is essential in the ever-evolving forex market. Remain updated on market events, refining your analysis skills through experience. Remember, achieving a proficient forex trader is a marathon that requires perseverance.

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Pauley Perrette Then & Now!

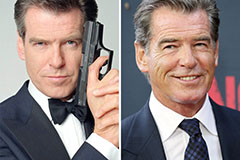

Pauley Perrette Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!